jersey city property tax phone number

City of Jersey City. TAXES PAYMENT 000 000 0 000 WEB CREDIT CARD 2035.

Nevada Tax Rates Rankings Nevada State Taxes Tax Foundation

Office of the City Assessor City Hall Annex 364 ML.

. Covid19njgov Call NJPIES Call Center. Ad Get Record Information From 2021 About Any County Property. 14502 00011 Principal.

1-800-882-6597within NJ NY PA DE and MD Office hours are Monday through Friday 830 am. Revenue Jersey tax Phone number 01534 440300 Email address jerseytaxgovje Opening hours Monday to Friday 830am to 5pm Address Taxes enquiry desk at Customer and Local Services. If you need more information you may contact us at 609-989-3070.

Unsure Of The Value Of Your Property. Inquire as to the status of an Inheritance or Estate Tax matter. Left to the county however are appraising property issuing levies making collections enforcing compliance and resolving disagreements.

City of Jersey City. Jersey City establishes tax levies all within the states statutory rules. For your convenience property tax forms are available online at our Virtual Property Tax Form Center.

You can call the City of Jersey City Tax Assessors Office for assistance at 201-547-5132. Real estate evaluations are undertaken by the county. 280 GROVE ST.

Remember to have your propertys Tax ID Number or Parcel Number available when you call. Please call the assessors office in Newark before you send documents or. Inheritance and Estate TaxService Center 609-292-5033.

Have Inheritance and Estate Tax forms mailed to you. King Drive 3rd floor Jersey City NJ 07305 email protected Edward Toloza CTA City Tax Assesor. Find All The Record Information You Need Here.

COVID-19 is still active. Online Inquiry Payment. 14 2022 614 pm.

Stay up to date on vaccine information. To view Jersey City Tax Rates and Ratios read more here. TO VIEW PROPERTY TAX ASSESSMENTS.

Construction Code 201 547-5055 9am - 430pm Mon - Fri City Hall Annex 1 Jackson Square Jersey City NJ 07305. You can call the City of Jersey City Tax Assessors Office for assistance at 201-547-5132. Jersey City taxpayers face one-two punch in tax hikes as council set to introduce 695 million municipal budget Updated.

To 530 pm except State holidays. For more information please contact the Assessment Office at 609-989-3083. Property Tax Payments and Installment Plans 609-989-3058.

Taxes for 2022 are due FEBRUARY 1 ST MAY 1 ST both. If you have documents to send you can fax them to the.

10 Us Cities With Highest Property Taxes

Granite Creek Capital Partners L L C Announces An Investment In Royal Biologics Ortho Spine News

Property Tax Definition Uses And How To Calculate Thestreet

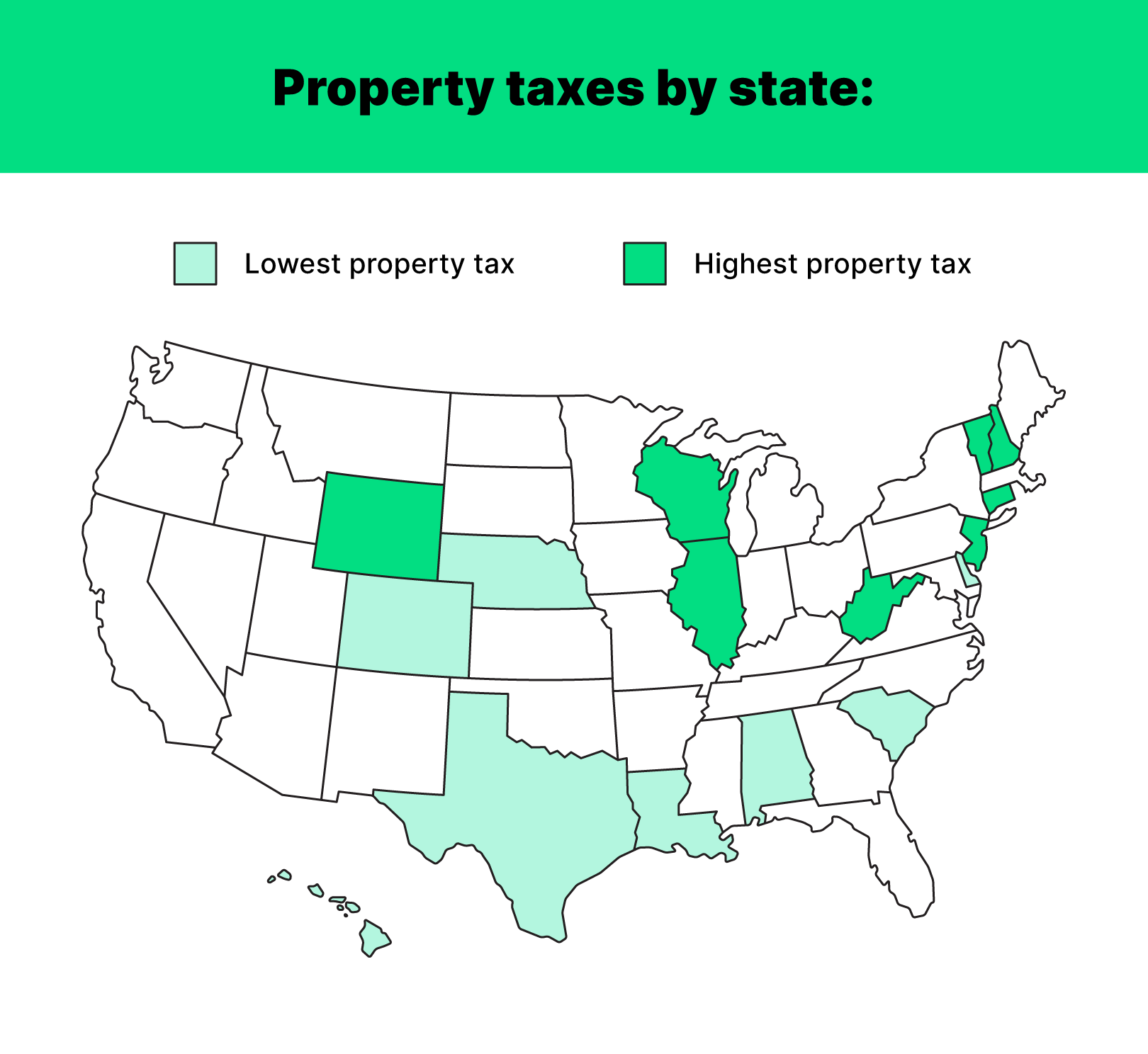

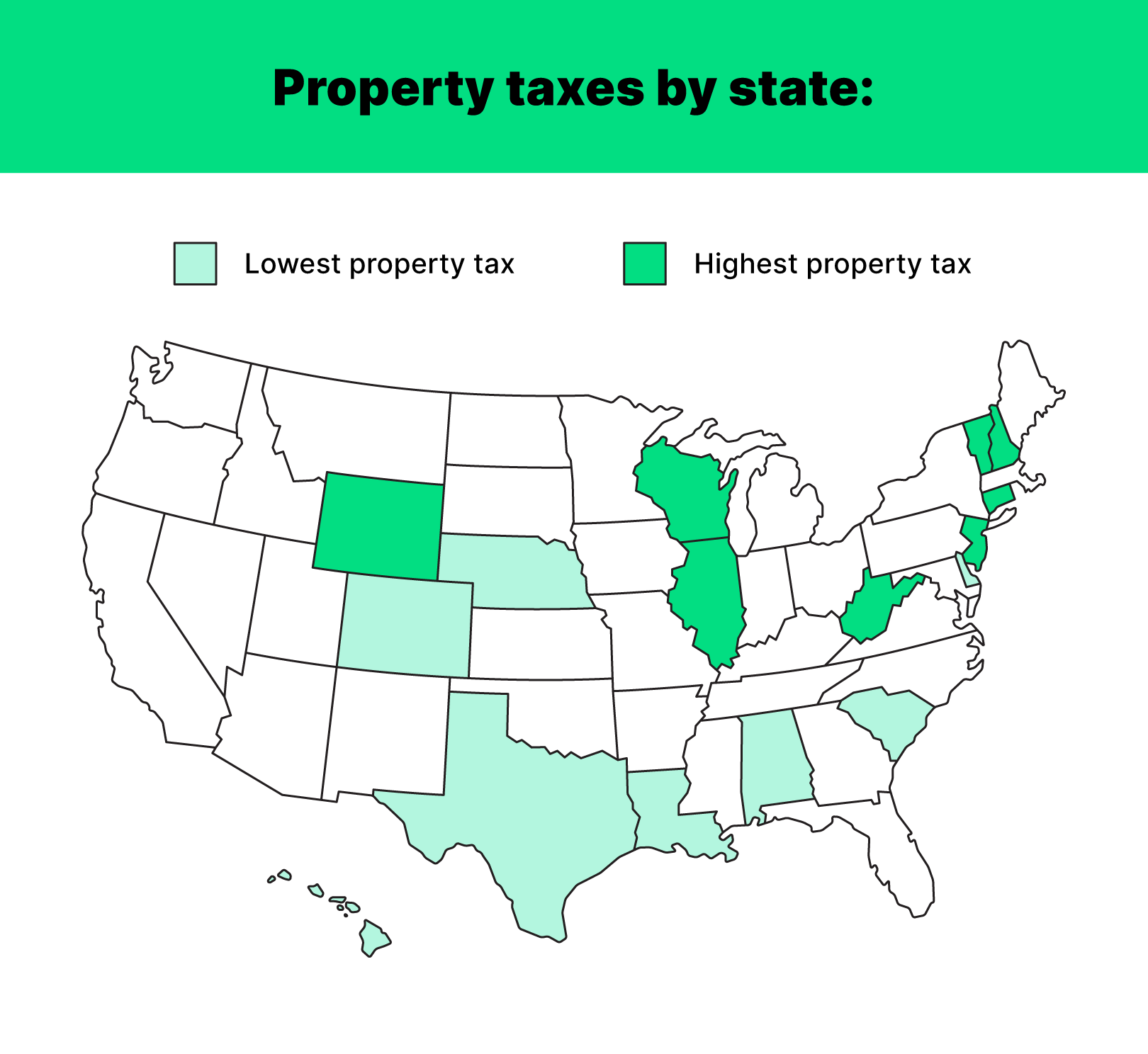

States With The Highest And Lowest Property Taxes

Property Taxes Haldimand County

Budget Info Graphic Budgeting Infographic Franchise Fee

Jersey City Unfairly Burdens Small Homeowners With Property Tax Burden Opinion Nj Com

Riverside County Ca Property Tax Calculator Smartasset

Monday Map State Local Property Tax Collections Per Capita Tax Foundation

Nyc Real Estate Taxes 101 Estate Tax Paying Off Credit Cards Utah Divorce

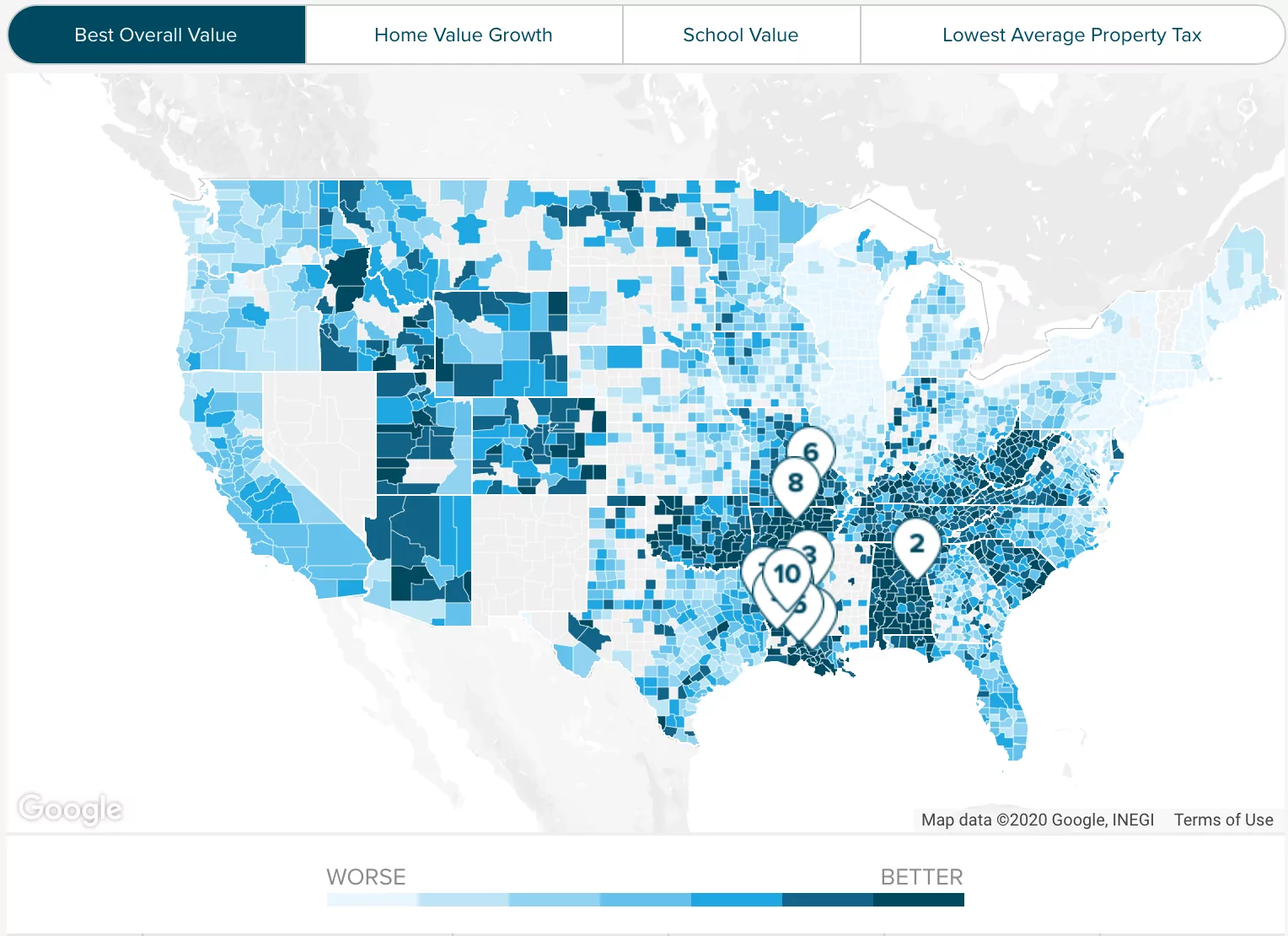

Your Guide To Property Taxes Hippo

Tamil Nadu Property Tax Hike 25 50 Hike Covers About 83 Of Houses The Hindu

30 Things To Remember When On The Hunt For A New Home Home Buying Process Workers Compensation Insurance Homeowners Association

Meet The Man Who Is Transforming Jersey City S Waterfront Jersey City Waterfront City

Pursuing A Property Tax Appeal In New Jersey Sharlin Law

Property Tax How To Calculate Local Considerations

Corporate Tax Manager At Henderson Harbor

Why Identical Homes Can Have Different Property Tax Bills Lincoln Institute Of Land Policy